12 Best Apps for Stock Research, Trading & Investment

Are you looking for the most efficient and effective tools for doing stock research, trading, and managing your investments? In today’s volatile financial landscape, having access to the right apps can mean the difference between your success as an investor. With 12 Best Apps for Stock Research, Trading & Investment we will guide you to make the right decision.

With so many options available, it can be difficult to identify the apps that provide the best combination of features, reliability, and user experience. Fortunately, we have compiled a list of the top 12 apps for stock research, trading, and investing in 2024. These apps meet all of your needs, whether you’re a seasoned investor or just getting started. They range from comprehensive research platforms to intuitive trading interfaces.

Let’s take a look at how these apps can help you streamline your stock market activities and maximize your investments. Read more such articles on Vantage Vista Blog.

Table of Contents

Toggle12 Best Apps for Stock Research, Trading & Investment

The 12 best apps for stock research, trading, and investment provide a plethora of features to meet a variety of investor needs. These apps offer a comprehensive platform for making informed investment decisions, including robust research tools and real-time market data. Whether you’re a beginner or an experienced trader, finding the right app can have a big impact on your investment journey.

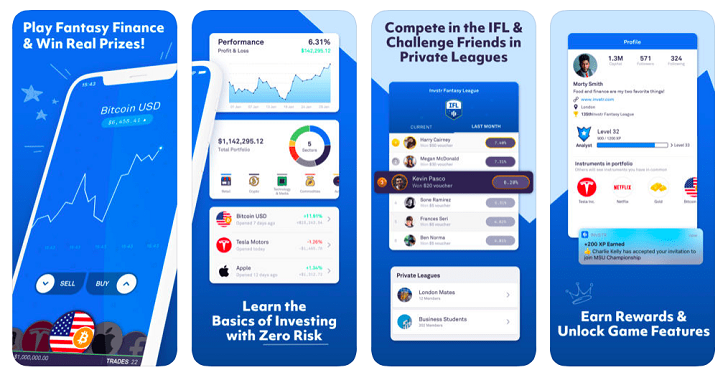

1. Invstr – Best app for education

The goal of the award-winning software Invstr is to teach and assist novice investors in the stock market through practice, instruction, and community involvement. By offering training, resources, and chances to become actual investors, the platform seeks to democratize access to financial information and enable people to take charge of their financial future.

Key Features:

Fantasy Finance: Gain market knowledge by managing a $1 million virtual portfolio.

Invstr+: Invest $5 to trade commission-free in US equities, ETFs, and cryptocurrency.

Invstr Pro: Get access to portfolios, statistics, and other educational tools.

Invstr Jr: An educational platform that teaches investing and money management to children and their parents.

Fees:

There is no cost to download or use the Invstr app itself.

For extra features, the monthly cost of the Invstr Pro subscription plan is $3.99.

Commission-free trading of cryptocurrencies and stocks listed in the United States.

Investing in fractional shares requires a $5 minimum.

Minimum Deposit and Balance Required:

To begin utilizing the app, there is no minimum deposit needed.

As little as $5 can be used by users to start trading.

Promotion:

Power Ups, Safety Net, and other extra features can be obtained through a variety of in-app purchases available on Invstr.

The app offers a number of discounts to improve the investing experience.

Invstr is ideal for:

Novices seeking to expand their knowledge of investment.

Those who want to practice trading virtually before making actual investments.

Those looking to improve their knowledge and abilities in investing through educational materials and a community of support.

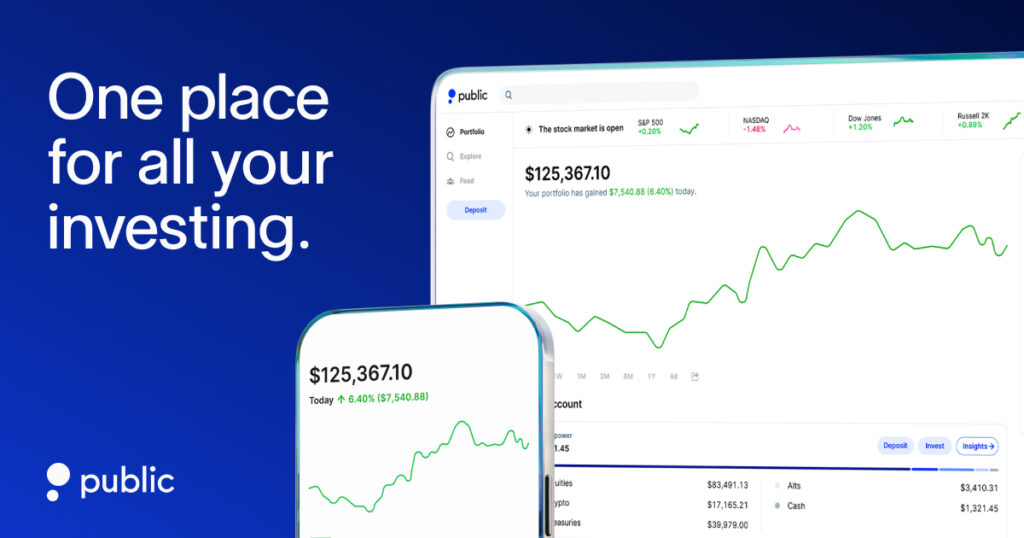

2. Public: The best app for learning about companies.

Public is a highly regarded software that provides an easy-to-use learning and investing platform, educating users about firms and the stock market. To assist users in understanding the firms they are interested in and making informed investment decisions, the app focuses on offering educational tools, real-time market data, and a community-driven approach.

Key Features:

Company Insights: Get access to comprehensive company information, including news, financial statistics, and performance indicators.

Educational Resources: Use interactive tools and resources to learn about company research, investing, and the fundamentals of the stock market.

Community Engagement: Participate in conversations about businesses and investments, exchange thoughts, and establish connections with other people.

Fractional Shares: Invest in businesses for as little as $1, giving users easy access to portfolio diversification.

Fees:

Commission-free trading on US equities and ETFs is provided by Public.

There are no deposit or minimum account requirements, so investors of all stripes can use it.

Customers don’t have to worry about expensive fees when they start investing any amount they feel comfortable with.

Minimum Deposit and Balance Required:

To register for an account and begin investing on the Public app, there is no minimum deposit or amount needed.

Because users can invest any amount they like, it’s appropriate for both novice and seasoned investors.

Promotion:

The general public may run promotions with incentives for friends to join the platform or benefits for referrals.

The app offers a range of promotional incentives that users can take advantage of to improve their investment experience and possibly receive prizes.

Public is ideal for:

People who are curious about businesses and the stock market.

Individuals seeking a community-oriented platform to interact with like-minded investors and exchange knowledge.

novices looking for tools and instructional resources to help them get started investing confidently and easily.

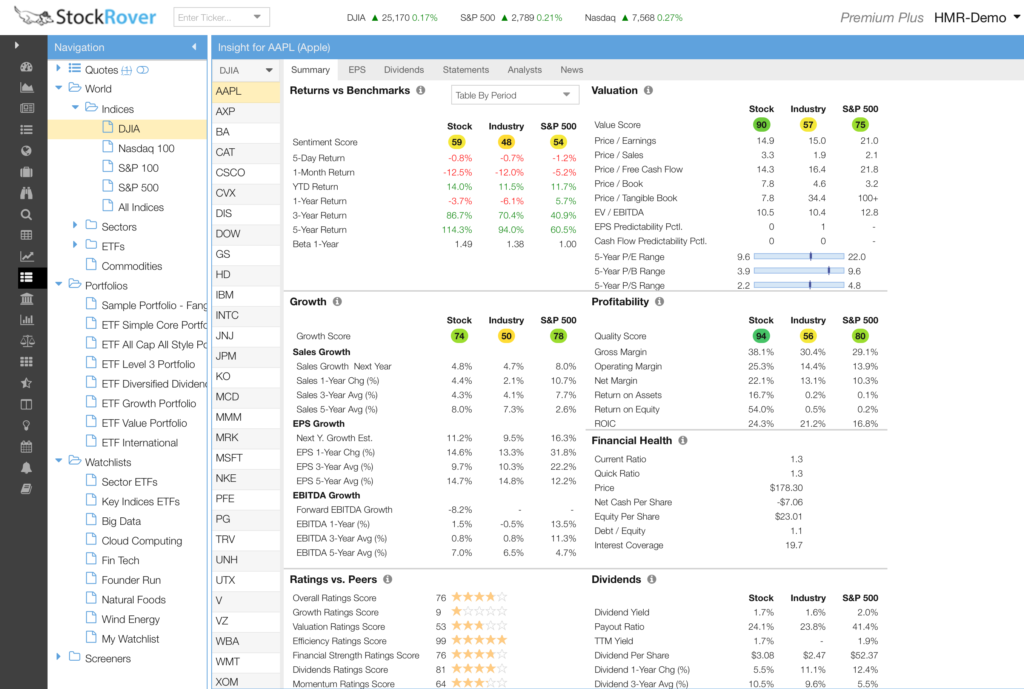

3. Stock Rover - The Best App for Stock Research

With its advanced capabilities for analyzing stocks, ETFs, and portfolios, Stock Rover is a comprehensive tool for investing research and portfolio management. The platform is excellent at offering comprehensive research, tools for comparison, and customisable insights to assist investors in making well-informed decisions and successfully optimizing their investment strategies.

Key Features:

Comprehensive Data: For the purpose of assessing stocks and ETFs, access more than 500 financial, operational, and efficiency measures.

Customizable Screeners: Select from a library of pre-made screeners or create your own using a variety of investment techniques.

Advanced Charting: Use up to twelve lines, technical indicators, dividends, and other visual aids to visualize the performance of your stocks.

Portfolio Analysis: Assess correlation matrices, risk-adjusted returns, sector allocation, and portfolio performance.

Research Reports: Get access to comprehensive research reports for in-depth information on more than 7,000 individual stocks.

Fees:

Three premium plans are available with Stock Rover: Essentials, Premium, and Premium Plus. There is also a free option.

The monthly cost of the Essentials plan is $7.99, the annual cost is $79.99, the Premium plan is $17.99, the Premium Plus plan is $27.99, and the annual cost is $279.99.

Research reports and premium options, such as direct phone help, may need additional costs.

Minimum Deposit and Balance Required:

Stock Rover does not require a minimum deposit or balance to be used.

Depending on their preferences, users can upgrade from free accounts to premium plans once they begin using the platform.

Promotion:

When a new member signs up for the free plan, they are eligible for a 14-day trial of the Premium Plus plan.

Prioritized, direct phone help is an option available to Premium and Premium Plus members for an extra cost.

To improve the user experience and gain access to premium services, a variety of promotional offers could be provided.

Stock Rover is ideal for:

Investors looking for sophisticated tools for stock analysis and research.

Customers seeking detailed insights into individual stocks and portfolios as well as customisable screeners.

Those looking to efficiently maximize their investment selections through comparison analysis, risk assessment, and portfolio management.

4. Robinhood – Best app for active trading and Investing

Popular app Robinhood is a great option for active traders and investors because of its commission-free trading and user-friendly layout. By giving consumers of all skill levels simple access to the financial markets, the website seeks to democratize investment. Robinhood offers a number of features to assist active trading and investment techniques, with an emphasis on accessibility and simplicity.

Key Features:

Commission-Free Trading: Trade cryptocurrency, equities, ETFs, and options without having to pay commissions.

Fractional Shares: Using modest sums of money, investors can diversify their portfolios by purchasing fractional shares of stocks.

24-Hour Market Access: An exclusive tool that lets you trade a few equities and ETFs five days a week, 24 hours a day.

Advanced Charting: Technical indicators for analysis are available, along with candlestick, line, and volume charts.

Educational Resources: Offers news updates and fundamental instructional materials to keep users up to date on industry developments.

Fees:

Commission-free trading on stocks, ETFs, options, and cryptocurrency is available through Robinhood.

It is affordable for frequent traders because there are no trading commissions or account administration costs.

Minimum Deposit and Balance Required:

Users can start investing with any amount they desire when they open an account with Robinhood because there is no minimum deposit or balance required.

Since users can start trading with as low as $1, novices and small investors can use it.

Promotion:

For new customers that sign up and fund their accounts, Robinhood may run promotions like free stocks.

Referral bonuses, sales promotions, and other incentives are available to users to improve their trading experience on the platform.

Robinhood is ideal for:

Active traders seeking a commission-free trading platform for fast and effective trade execution.

investors that want to trade cryptocurrency and fractional shares without paying fees.

Individuals looking for an easy-to-use interface and fundamental instructional materials to assist with their trading and investing.

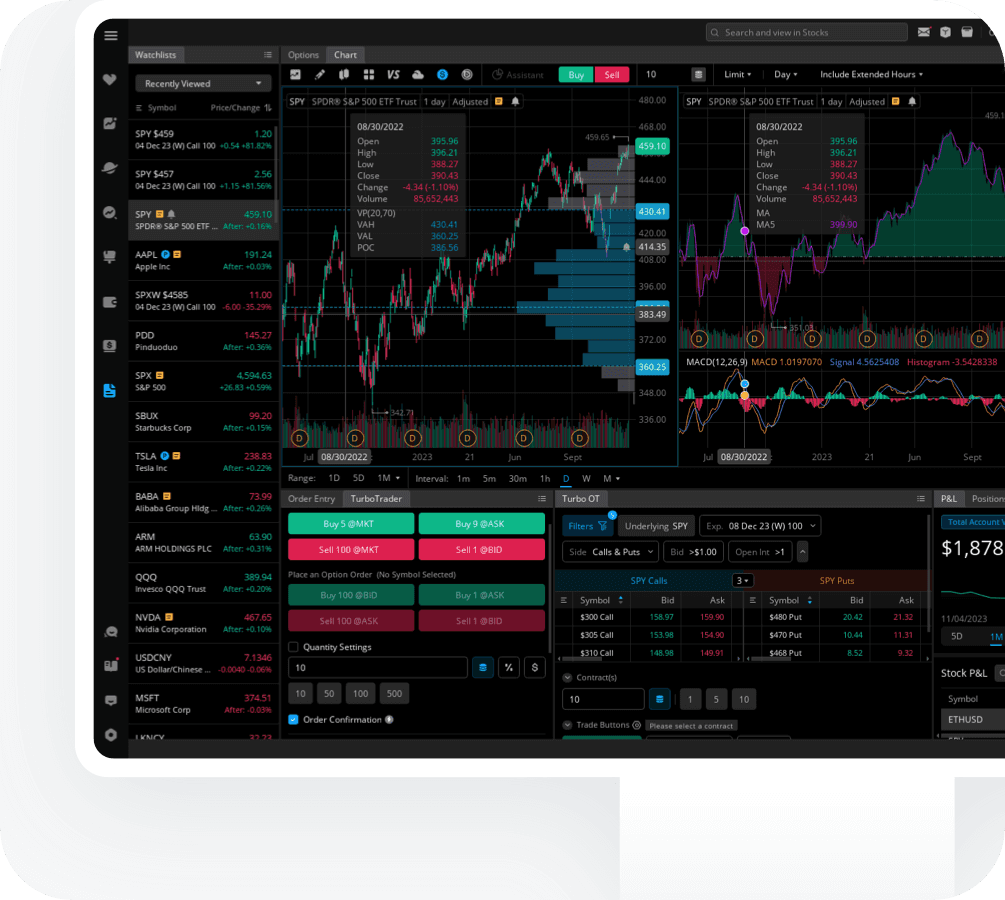

5. TradeStation – Best app for active trading and Investing

For aggressive traders and investors looking for cutting-edge features and tools to improve their trading experience, TradeStation is a feature-rich trading platform. TradeStation serves a broad spectrum of customers, including day traders and institutional investors, with an emphasis on advanced research, customisation, and real-time data. The platform is a flexible solution for investors wishing to diversify their portfolios because it provides a wide range of investment options, such as stocks, ETFs, options, futures, bonds, and cryptocurrencies.

Key Features:

Sophisticated Trading Platform: Well-known for its robust desktop platform that offers real-time market scanning, automated trading, and sophisticated charting.

Customization: It is perfect for traders with particular needs because it offers a wide range of customization options that let users create, test, and automate their trading methods.

Range of Offerings: Trade stocks, bonds, mutual funds, ETFs, options, futures, and cryptocurrencies, among other securities.

Educational Resources: News updates, research tools, and market insights to assist users in making well-informed trading decisions.

Mobile Trading: Provides a feature-rich mobile trading application for trading and investment monitoring while on the road.

Fees:

Commission-free stock and ETF trading is available on TradeStation, along with competitive commissions on mutual funds, options, and other investment products.

The rate of margin varies according to the amount in the account; rates for balances under $50,000 start at 9.50%, and as the balance increases, the rate drops.

Minimum Deposit and Balance Required:

If a user intends to use TradeStation’s web platform, they can open a brokerage account with no minimum initial investment required.

Higher balances are subject to lower margin rates, which are tier-based on account balance.

Promotion:

Depending on their first deposit, new account holders can get a cash rewards bonus of $50 to $5,000.

For new users, TradeStation may provide incentives and promotions in the form of bonuses and cash awards.

TradeStation is ideal for:

Proactive traders looking for an affordable, feature-rich platform with sophisticated trading tools.

those who wish to trade a variety of securities, including as futures, options, stocks, and cryptocurrencies.

traders that want to automate and customize their trading tactics.

Users who value real-time data, research tools, and in-depth market analysis to help them make trading decisions.

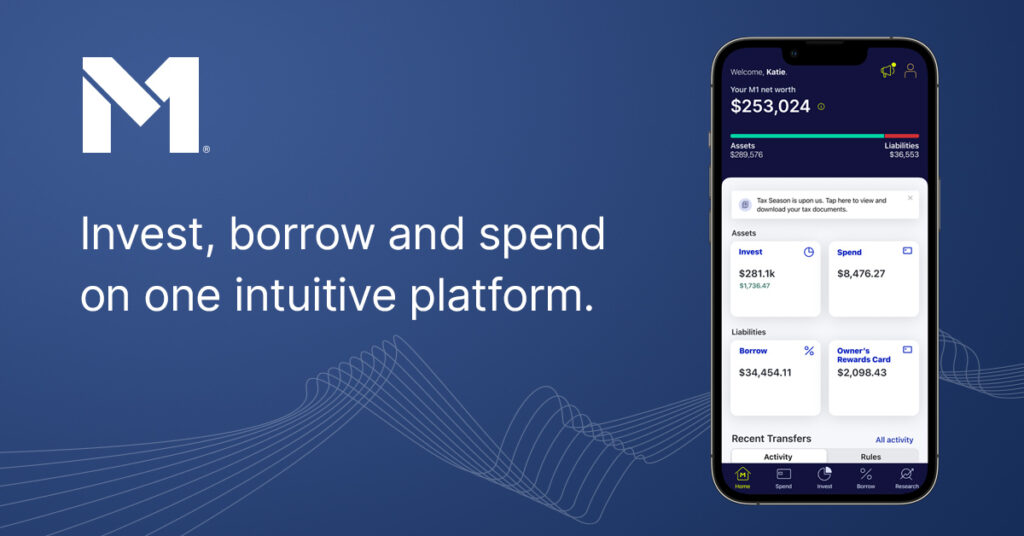

6. M1 Finance - Best for Stock and ETF Portfolis

M1 Finance is a brokerage platform that combines automation and customisation to provide users with effective portfolio management and visualization. M1 Finance prioritizes user control and simplicity, enabling clients to build diverse stock and ETF portfolios that are customized to their risk tolerance and financial objectives. The platform appeals to long-term investors who want a hands-off approach to investing since it combines the advantages of automation with the flexibility of customizing each unique portfolio.

Key Features:

Customizable Portfolios: Using a combination of stocks and exchange-traded funds (ETFs), users can build investment portfolios that are tailored to their individual needs and goals.

Automation: M1 Finance provides consumers with automatic investing tools that enable them to make regular investments over time, supporting efforts to accumulate wealth.

Morning Trade Window: Every M1 customer has access to a morning trade window that begins at 9:30 a.m. ET. M1 Plus members who have over $25,000 in their account are eligible for a second trade window that begins at 3 p.m. ET.

Research and Data: To assist users in making wise investing decisions, the platform offers access to market data, research tools, and instructional materials.

High-Yield Savings Account: Uninvested funds are deposited into a 5% percent high-yield savings account that is insured up to $5 million by the FDIC.

Fees:

M1 Finance does not impose any annual or outgoing transfer fees; nevertheless, there is an outgoing transfer cost of $100.

The site offers commission-free stock trading as well as no fees for ETF investments.

Minimum Deposit and Balance Required:

To start an account with M1 Finance, you must deposit $100 for brokerage accounts and $500 for retirement accounts.

Investing can be started with as little as $100, so people of all financial capacities can take part.

Promotion:

Cash rewards bonuses and other promotional offers are only a few of the perks and incentives that M1 Finance may provide to new customers.

For uninvested cash balances, the site offers a high-yield savings account option with competitive interest rates.

M1 Finance is ideal for:

Long-term investors looking to manage their investments in a detached manner.

those who want to assemble diverse stock and exchange-traded fund (ETF) portfolios based on their financial objectives.

Those looking for features that mix customisation possibilities with automatic investing.

Investors who prioritize ease of use, affordability, and availability of instructional materials in order to make well-informed decisions about their investments.

7. Wealthbase – Best app for trading games and contests

With its fantasy stock trading activities and competitions, Wealthbase is a highly recommended program that gives users an enjoyable and engaging method to learn about investing while competing with peers. Wealthbase blends the thrill of stock market games with the educational value of teaching users how to trade stocks, ETFs, and cryptocurrencies in a risk-free environment, with an emphasis on social investment and simulated trading.

Key Features:

Fantasy Stock Trading Games: To compete against other Wealthbase users and win prizes, users can take part in daily, weekly, and monthly fantasy stock trading tournaments.

Diversified Asset Selection: To build a simulated portfolio and monitor performance, trade more than 30,000 equities, ETFs, and cryptocurrency pairs.

Realistic Trading Experience: Take advantage of real-time order fulfillment, up-to-date stock prices, historical data, and a social media network to interact with other users and friends.

Leaderboards and Social Interaction: Follow other users, interact with friends, exchange ideas, and vie for the top spots on leaderboards.

High-Yield Savings Account: Free high-yield cash account access along with FDIC insurance protection for cash amounts that aren’t invested.

Fees:

Games with up to five players can be played for free on Wealthbase.

A $20 game charge, up to 1,000 participants, plus five cents per player every day, apply to larger games.

Minimum Deposit and Balance Required:

Utilizing Wealthbase does not require a minimum deposit.

All levels of investors can use it because there is no minimum balance required to start trading or entering contests.

Promotion:

To encourage users to sign up and take part in trading games and contests, Wealthbase may run promotional contests or give other incentives.

Users can participate in a risk-free atmosphere and learn about investing on this platform, which offers a realistic and entertaining experience.

Wealthbase is ideal for:

People who want to use simulated trading games to learn about investment.

Users seeking a social investing platform where they can interact with friends and take part in competitions.

those looking for a risk-free, entertaining method to practice trading stocks, ETFs, and cryptocurrency.

Individuals and groups interested in honing their trading techniques, monitoring their progress, and taking part in an engaging and instructive investment journey.

8. Fundrise – Best app for direct investment in real estate

Providing people with the chance to participate in top-notch private market assets like real estate, venture capital, and private credit, Fundrise is a well-known platform for direct real estate investing. Fundrise enables users to create a portfolio of assets that are well-positioned to protect and increase wealth over time, with an emphasis on accessibility and diversification.

Key Features:

Real Estate Investing: Investing in private real estate assets through Fundrise offers consumers the chance to generate steady cash flow through income and long-term growth.

Investment Variety: To accommodate a variety of risk appetites and investment objectives, the platform provides a selection of investment strategies, ranging from safe income funds to higher-risk growth real estate funds.

Account Tiers: Fundrise lets users select the account tier that best suits their investing needs by providing a range of features and perks.

Transparency: Fundrise places a strong emphasis on openness by giving consumers access to comprehensive data on ongoing real estate investments, project milestones, and portfolio growth.

Security: With bank-level encryption protecting investment data and two-factor authentication available for enhanced security, the platform places a high priority on security.

Fees:

For all account sizes, Fundrise levies an annual advisory fee of 1%. For particular real estate developments, there can also be extra costs, such as development or liquidation fees.

Minimum Deposit and Balance Required:

A diverse spectrum of people wishing to invest in real estate can use Fundrise because it offers an initial $10 investment opportunity. For those who want to progressively increase the size of their investing portfolio, there are customizable minimums starting at $10.

Promotion:

Promotions from Fundrise could include a free 30-day trial of their Fundrise Pro service, which enables more involved clients to personalize their portfolios. There is an extra fee of $10 per month or $99 annually for this service.

Fundrise is ideal for:

Long-term investors looking for diversification sources other than standard stocks and bonds.

Those wishing to make real estate investments without having to deal with the headaches of property ownership or landlord duties.

Those who are prepared to study and perform their own due diligence before making an investment.

Individuals who wish to accumulate a varied assortment of private market investments with the possibility of yielding income and long-term expansion.

When it comes to direct real estate investing and reaping the rewards of this asset class, Fundrise is a great alternative because of its easy-to-use platform, wide range of investment possibilities, emphasis on transparency, and accessibility.

9. Rocket Dollars - Best app for IRAs

With the help of Rocket Dollar, self-directed IRA users can invest in assets other than conventional equities and bonds. Giving customers more power and flexibility over their investing options, it provides a platform where they can use their retirement assets to invest in startups, real estate, cryptocurrencies, and other alternative investments.

Key Features:

Alternative Investments: More varied investing options are provided by Rocket Dollar, which enables users to invest in a variety of alternative assets including real estate, cryptocurrency, and private equity.

Self-Directed IRAs: By opening a Solo 401(k) or self-directed IRA, users can explore non-traditional investing options and exercise more control over their money.

Educational Resources: To assist users in making well-informed investing decisions, the platform offers a vast library of articles, webinars, and podcasts covering a range of investment topics.

Transparent Fees: Rocket Dollar levies a $360 setup price in addition to a $15 monthly maintenance fee. Depending on the investments that users make, there can be additional costs.

Fees:

Rocket Dollar charges $15 a month for upkeep and $360 for setup. Moreover, extra costs might apply to users based on the precise assets they select.

Minimum Deposit and Balance Required:

To open a retirement account with Rocket Dollar, there is no minimum initial deposit needed. Because of this, a broad spectrum of individuals who want to investigate alternative assets for their retirement savings can access it.

Promotion:

At this time, Rocket Dollar is not running any special sales or deals. Nonetheless, it offers helpful tools and instructional materials to assist users in successfully navigating self-directed investment.

Rocket Dollar is ideal for:

Those want to include alternative assets, such as real estate, cryptocurrencies, and startups, in their retirement portfolio.

Self-employed people looking for possibilities for self-directed investing, or those with large IRAs or rollover IRAs.

Investors who want to investigate non-traditional investment options and regain more control over their retirement assets.

Users who value self-directed investing advice and educational materials.

10. Backer - Best for setting up a 529 college savings plan

With the help of the Backer platform, users can quickly build a collaborative environment where friends and family can simply donate to a child’s education fund, making it easier to set up a 529 college savings plan. It provides tools and an easy-to-use internet interface to make saving money for college expenditures more efficient.

Key Features:

Collaborative Saving: Backer makes it simple for friends and family to contribute to a child’s school fund by allowing numerous contributors to join a single 529 plan.

Personalized Fund Pages: Contributors can make one-time or recurring contributions using a variety of payment options on personalized fund pages that users can construct.

Low Minimum Contribution: Backer guarantees accessibility for all participants, irrespective of their desired investment amount, by requiring an only $5 minimum payment.

Promotional Bonuses: To encourage involvement and contributions, the backer gives a $10 bonus to each new backer that contributes to a child’s college fund.

529 Plan Setup: Backer helps users who do not already have a 529 plan to establish a Utah-based plan, making the process of starting college savings easy.

Fees:

The Backer 529 plan, which offers a systematic method of administering and expanding a child’s college savings fund, has a $5 monthly fee charged by Backer.

With two or more backers, uninvested funds are free, giving consumers access to cost-effective savings choices.

Minimum Deposit and Balance Required:

Backer allows users of all financial backgrounds to open accounts with it because there is no set minimum deposit needed.

With as little as $5, users can begin their college savings journey, guaranteeing inclusion and flexibility in the process.

Promotion:

To encourage involvement and engagement in the saving journey, Backer offers a $10 incentive to each new backer who makes a contribution to a child’s college fund.

The platform is a desirable choice for individuals and families trying to establish a strong foundation for future educational costs since it provides a smooth and cooperative method of saving for college.

Backer is ideal for:

Individuals and families looking for a cooperative platform to save money for a child’s college expenses while enlisting friends and family in the process.

People who want a convenient and user-friendly way to open and manage a 529 account for college savings.

Those want to boost their college savings efforts with promotional bonuses, minimal minimum contributions, and customizable fund sites.

People who do not currently have a 529 plan and who need help setting up an organized college savings account to cover their child’s future educational costs.

11. Plynk Invest - Best for easy-to-use interface

The goal of the investing software Plynk Invest is to make investing easier for its users by providing a simple, user-friendly platform that can be used by both novice and seasoned investors. It focuses on removing the obstacles and complexities that are frequently connected to investing, making it approachable and simple for investors of all experience levels.

Key Features:

Simplified Investing: With tools and resources to help customers make wise investing decisions, Plynk Invest offers an easy-to-use interface that streamlines the investment process.

Educational Tools: To help users improve their understanding of investing, the app provides educational tools such as Plynk Explore, expert ratings of stocks and funds, and investment themes and categories.

Low Minimum Investment: Plynk allows users to begin investing with as little as $1, making it accessible to people of all financial backgrounds.

Commission-Free Trading: Plynk Invest is an affordable option for investors since it does not charge commissions for users to trade stocks, mutual funds, or exchange-traded funds (ETFs).

Fees:

Plynk Invest provides Digital Brokerage Services LLC (DBS) retail clients with commission-free trading on U.S. equities trades, ETFs, and mutual funds. Separate costs, though, are associated with each cryptocurrency trade.

Minimum Deposit and Balance Required:

Plynk Invest does not have a minimum deposit requirement, so users can begin investing with as little as $1. A broad spectrum of investors can access it due to its low barrier to entry.

Promotion:

Plynk Invest offers new users a $10 sign-up bonus as a way to encourage them to begin using the site for investing. Users are encouraged to explore the app and start investing with a bonus as a result of this campaign.

Plynk Invest is ideal for:

Novice investors seeking an easy-to-use platform with simplified investing tools and educational resources to launch their investment career.

Those seeking a low-cost, commission-free option to trade stocks, mutual funds, and exchange-traded funds (ETFs).

Those want to diversify their investment portfolio by investigating categories, expert ratings, and investing themes.

Plynk lets investors to start with as little as $1, making it an excellent option for anyone wishing to start investing with minimum financial commitment.

12. Webull - Best app for active investing and saving for retirement

With a strong online trading platform, Webull serves active customers who want to trade equities, futures, exchange-traded funds, and cryptocurrencies. For those who are interested in active investing, it is the best option because it provides commission-free trading, retirement accounts, and margin trading. Webull offers an easy-to-use platform to individuals who are prepared to actively manage their investments, despite not being a management services provider.

Key Features:

Commission-Free Trading: Webull is an affordable solution for active traders since it does not charge commissions for customers to trade stocks, options, ETFs, or cryptocurrencies.

Retirement Accounts: Users can actively manage their investments while saving for retirement with the platform’s access to tax-advantaged IRAs.

Advanced Trading Tools: Webull caters to intermediate to advanced traders by offering comprehensive charting and analysis, sophisticated orders, Level II market data, and customisation choices.

Free Stock Welcome Bonus: As a way to encourage new investors, users who open and fund a new account can earn free stocks.

Fees:

Webull provides commission-free trading for cryptocurrencies, equities, ETFs, and options. Customers can take advantage of a 5% APY on cash that isn’t invested, and there are no account fees.

Minimum Deposit and Balance Required:

Webull does not need a minimum deposit to register an account, so consumers may begin investing right away without having to make any upfront payments. To begin investing, there is also no minimum balance needed.

Promotion:

When customers open and fund a new account with Webull, they will receive free stocks as part of the promotion. When beginning their investing adventure, users receive added value from this gift.

Ideal For:

Active investors who feel comfortable managing their portfolios and are searching for a platform that provides access to retirement accounts, a large selection of investment options, and cutting-edge trading tools are best suited for Webull. It’s perfect for people who want to save for retirement and trade actively at the same time.

12 Best Apps for Stock Research, Trading & Investment Final Thoughts

I hope you found the suggestions and recommendations in this article useful in your search for the best apps for stock research, trading, and investing. As you navigate the complex world of financial markets, having the right tools can help you succeed as an investor. These 12 apps provide a wide range of options to meet your needs, whether you want in-depth research capabilities, intuitive trading platforms, or comprehensive investment management features.

Why wait? Take action now and check out these apps to see how they can improve your stock market experience. Implementing the suggestions based on your needs can help you make better decisions, optimize your trading strategies, and ultimately meet your investment objectives.

I would love to hear about your experiences and journey with these apps. Please leave your feedback in the comments section below. Your insights can not only assist others in their investment endeavors, but also contribute to the continuous improvement and innovation in the world of stock market apps. Happy investing

Leave a Reply